A Deep Dive into Khazna

Welcome to my new newsletter The venture reader, I love studying & analyzing startup & scaleup ventures, so I thought about sharing my thoughts in public. This is my first deep dive and first article . I thought I should start by analyzing one of my favorite startup companies in Egypt, Khazna. Khazna is is a stellar company with an exceptional team aiming to serve Egypt’s underbanked population. So, shall we start?

Table of Content

Further Depth: Who are the underbanked?

Employment status

Education

Jobs

Job Sectors

Industry & Competitive landscape

Industry Landscape

App installs

Active Users

Partners & Merchants

Strategic Powers & Economic Moats

Economies of Scale

Operational efficiency & Low-cost

Embedding

Network effects

Product Expansion

ROSCAs

Digital Saving

Group Lending

Summary

Company Thesis

In 2019, Egypt had a high smartphone penetration rate of around 95%, but half of Egyptians lacked access to formal financial services. Only 50% of Egyptian adults (30 million) had transactional accounts, such as bank accounts, prepaid cards, or mobile wallets. Khazna sees a significant opportunity in addressing this gap in financial services due to the large underserved market, the country's openness to digital solutions, and government/regulator alignment.

The Founding story

After earning his MBA from Stanford, Omar Saleh got back to Egypt with a desire to make a positive impact on Egypt’s society. He got intrigued by the financial industry when he got rejected for a credit card. Saleh got passionate about the sector and transitioned from energy to fintech and joined WorldRemit, a leading payment company to lead its launch in the Middle East. When Omar Saleh saw the Central bank & government regulations changing and encouraging financial inclusion through different initiatives, he knew this was the right time to start his company.

In late 2019, Saleh started Khazna with the mission of providing financial services access to the underserved population in Egypt.

In 2020, Ahmed Wageeh, Fatma ElShenawy, & Omar Salah joined as co-founders, driven by the same desire of making a positive impact on people’s lives. After initial research, the founding team saw employer credit as a valid entry point to providing financial services. As they have discovered that many Egyptians borrow from their employers.

Management Team

A key differentiator for Khazna is their exceptional team. Omar Saleh, founder & CEO, is a GSB alumni, with extensive senior executive experience in fintech (WorldRemit), energy, and investment banking (JP Morgan).

The co-founders include Omar Salah, who led the Shared Rides marketplace at Uber Egypt, Fatma El Shenawy, an experienced investment banker, and Ahmed Wageeh, the Chief Technology Officer, with over 20 years of experience in engineering & product management at multinationals like Intel, IBM, and Valeo.

Khazna has attracted top-notch talent, such as Dina Gobran, the CSO, who previously worked as a consultant at McKinsey and served as the General Manager of OLX Egypt, and Ahmed Mohsen, the COO, who was the CX regional lead of Uber MENA. The rest of the senior and mid-management team is equally capable.

Based on an analysis of Khazna's LinkedIn Page, the company has 250 employees, with the majority working in customer/community support functions. There are approximately 20-25 software engineers, 35-45 in sales & corporate sales, and around 30 employees in operations. Notably, Khazna has a relatively large strategy team compared to other Egyptian startups.

Product offering

Khazna offers various financial products to its users, including:

Salary Advancement: Users can receive an advance of 30% to 100% of their monthly income with a payback period of up to 10 months.

Salary Transfer: Employers can transfer salaries to their employees' Khazna app, which can be accessed.

Salary Slip: Users can access a digital payslip and view the breakdown of their pay (base, commission, taxes, social insurance, etc.).

Bill Payment: Users can conveniently pay different bills (gas, electricity, internet, etc.) through the app.

BNPL (Buy Now Pay Later): Users can purchase a variety of products (electronics, clothes, etc.) from over 1000 stores in installments with zero upfront payment and zero interest.

Khazna Card: Users receive a prepaid Meeza card for payroll, cash withdrawal & deposit, and online shopping.

What distinguishes Khazna as a platform is its user-centric & customer-obsession approach that aims to provide a seamless user experience for all users. The app is designed to make each milestone can be done in 2-3 clicks.

Market Analysis

Khazna's target market is Egypt's unbanked and underbanked population. In 2019, this group comprised around 34 million citizens, representing approximately 52% of Egyptian adults, a figure that decreased to 35% by 2022. However, according to World Bank data, only 27% of Egyptian adults (17.5 million) have accounts in financial institutions as of 2021.

Additionally, the World Bank reports that 58% of Egyptian adults find it challenging to come up with emergency funds within 30 days. This makes credit solutions like Khazna critical to millions of Egyptians.

Further Depth: Who are the underbanked?

Egypt's labor force consists of approximately 29.3 million citizens, with 67% (19.7 million) employed and 17% self-employed. Khazna's current B2B2C strategy targets the 20 million employees in Egypt.

Employment Status

80% of Egyptian employees work in the private sector, with 56% (12 million workers) employed outside establishments.

90-97% of these workers lack social insurance, health insurance, or work contracts, while 65% of inside-establishment private sector workers also lack these benefits. Only 3% of government sector workers face these issues.

Khazna's products cater to government and private sector workers with work contracts, serving around 9 million workers.

Education

The Egyptian labor force has diverse educational backgrounds, with 34% having technical secondary education and 38% being illiterate, semi-literate, or having less than intermediate education. So more than 70% of Egypt’s labor force have mainly blue-collar jobs.

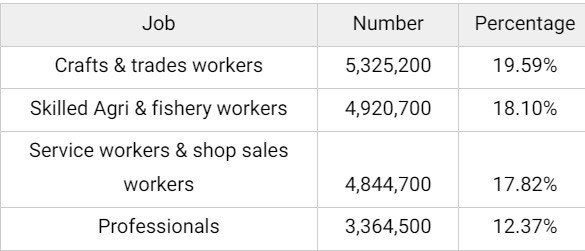

Jobs

50% of Egypt's workforce consists of trade, agriculture, or service workers, while 12.73% are professional workers such as doctors, lawyers, and teachers.

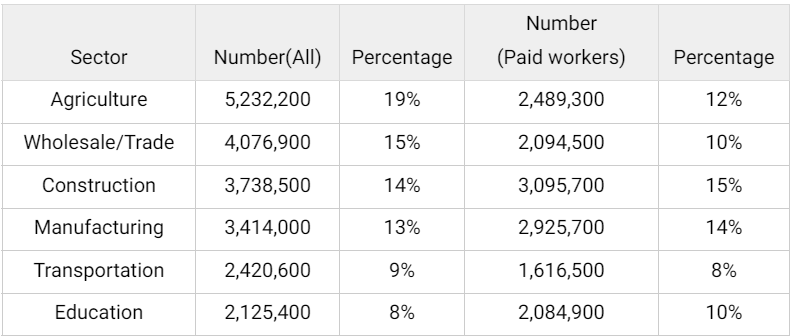

Job Industries

Agriculture represents the largest sector in terms of total workers in Egypt, with close to one-fifth of Egyptians working in this field. However, if we consider only paid workers, we find that construction and manufacturing workers represent the majority of the paid labor force, accounting for 15% and 14% respectively.

The data we presented highlights the structural problems of Egypt's labor economics, but also the potential for entrepreneurial companies like Khazna to solve them.

Industry & Competitive landscape

Industry Landscape

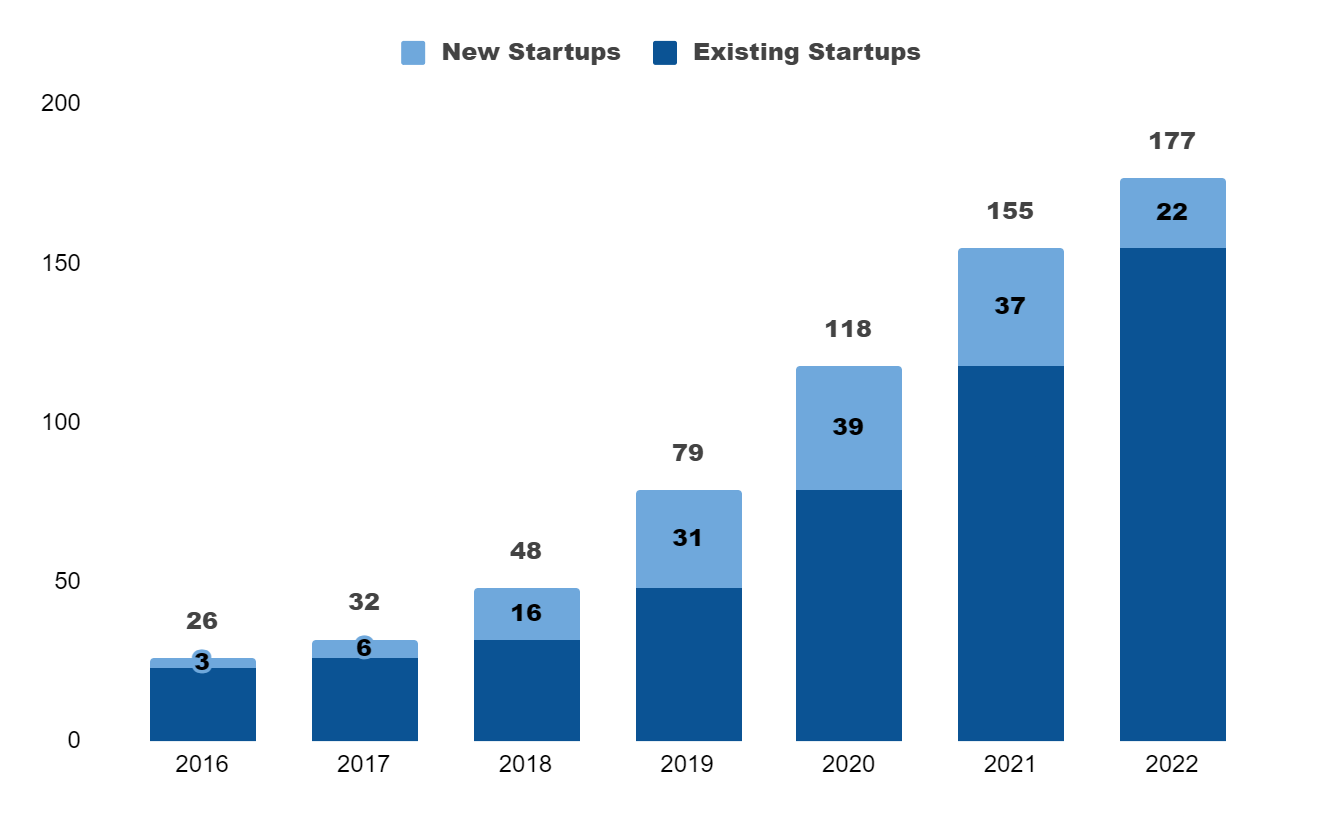

The fintech sector in Egypt has experienced significant growth over the past seven years, driven by rising demand, global trends, and government regulations & reforms.

This growth has positioned Egypt's fintech sector as one of the most funded tech sectors in the country and the region. The number of fintech & fintech-enabled startups has increased almost 600% over the past 7 years, indicating the sector's rapid expansion.

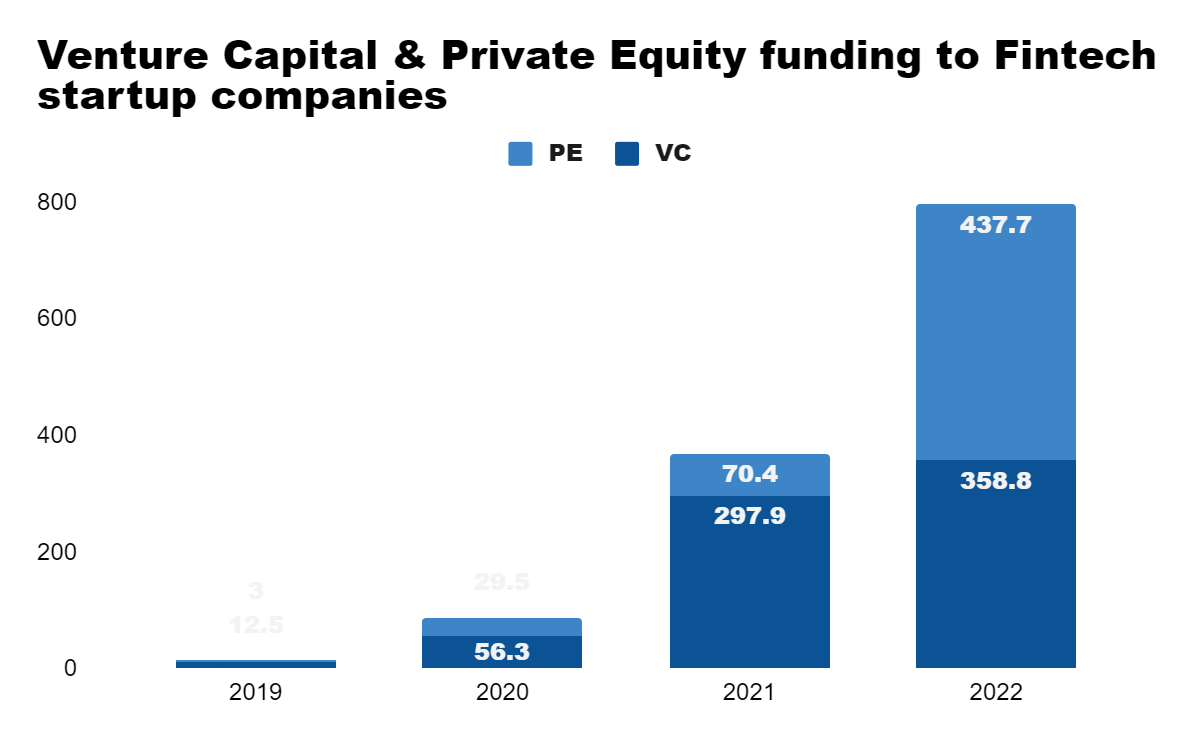

Venture & private equity funding has also seen substantial growth, increasing 50X during the past 4 years. In 2022, total VC & PE funding to Egypt fintech companies was close to USD 800 mn.

The Central Bank of Egypt has been supporting the development of the fintech ecosystem through regulation, funding, governance, and talent development. The CBE has also developed a financial inclusion strategy aligning with Egypt’s 2030 Vision

Competitive Landscape

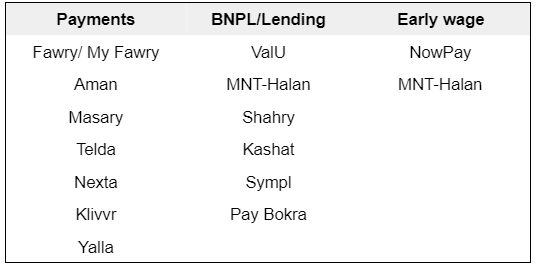

There are various local fintech players in Egypt offering similar solutions like Khazna or targeting the same set of users. We highlighted the key players in each category in the table below.

The important competitors for Khazna are two companies: MNT-Halan & NowPay

MNT-Halan is Egypt's most funded startup, with over USD 600 million in funding and a valuation of USD 1 billion. It offers a range of financial products to Egypt's underbanked population, including bill payment, BNPL, microloans, digital wallets, and others. However, MNT-Halan follows a different go-to-market strategy, targeting the same audience as Khazna but scaling through a B2C model. According to their website, MNT-Halan has served 5 mn users & issued USD 2.5 bn in loans.

NowPay is a YC-backed early wage access company that offers bill payments and has received USD 3.7 million in funding. According to the company website, it has 300K users and 250 employers, although the company’s android app has only +50K installs. While NowPay and Khazna offer similar product offerings, NowPay seems to focus on the middle and higher-middle income segment in Egypt.

Business Model & GTM Strategy

Khazna's business model and strategy are B2B2C. They partner with large employers and onboard their employees on their app. Employees sign up to the app, verify their identities and employment, and receive their cards to start using Khazna's different products.

The company has multiple revenue streams, including:

Earned Wage Access: Khazna charges monthly fees for its earned wage access service

Bill Payment: The app takes a transaction fee on bill payments made through its platform.

BNPL: Khazna also takes a transaction fee on each Buy Now, Pay Later (BNPL) transaction between its users and partners.

The B2B2C model has 3 core advantages that helps Khazna acquire and maintain customers, but also has some disadvantages.

Advantages of B2B2C Model

Customer Acquisition: By direct partnerships with businesses, Khazna gains easy and low-cost access to their employees as a potential user base. This strategy establishes user trust instantly, which is a crucial factor in user acquisition for financial services providers.

Customer Retention: Khazna's users access their income or pension through the Khazna app/card. This ease of access & convenience encourages users to utilize the app for other services such as bill payments, in-store and online purchases, and,of course, accessing credit in the form of early wage.

Risk Management: With initial access to users' income, Khazna can automatically deduct monthly fees. This proactive approach reduces the default rate of loans, leading to more competitive lending rates, which reflects user acquisition.

Super apps have generally succeeded by dominating one category/feature first and then encouraging their users to adopt other features/categories.

Disadvantages of B2B2C Model

The primary drawback of the B2B2C model lies in its limitations within the Egyptian market. As mentioned in the market analysis section, only 32% of Egypt's workforce has social insurance and employment contracts. The number of employees in large organizations that Khazna aims to target, is much smaller.

Most employees are outside-establishment private workers with no social insurance or work contracts. These employees are often trades, agriculture, or service-workers in microbusinesses or shops.

Traction & Growth

App installs

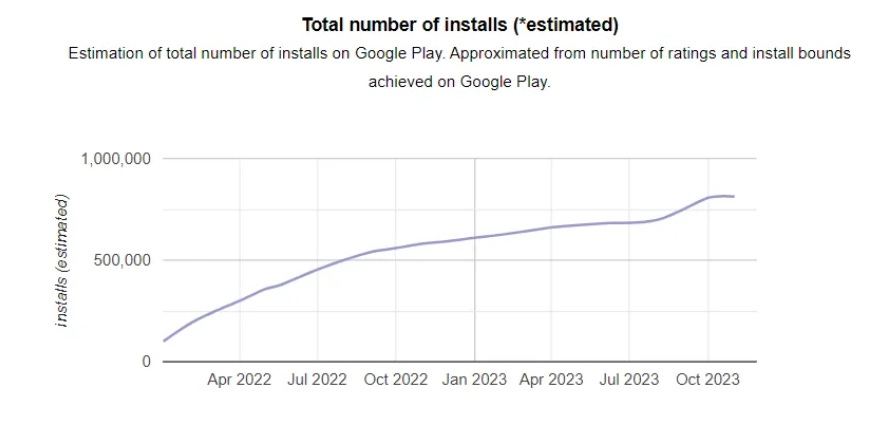

According to Android Rank, Khazna's Android app has over 800,000 installs, while the iOS app, based on personal estimates, stands at approximately 20,000 downloads.

The graph below provides an estimate of the growth in installs for Khazna's Android app over the past 1.5 years

Active Users

At the start of 2022, Khazna reported having 150,000 active users, and by the end of the year, this figure had doubled to 300,000 active users. Our estimate suggests that Khazna has between 500,000 to 600,000 active users.

Employers & Merchants

Khazna has partnered with approximately 230-250 major employers across various sectors. Notable clients include Egypt Post, Vodafone Egypt, Orascom Development, PepsiCo Egypt, Uber Partners, as well as several hospitals, professional syndicates, and sports clubs.

Khazna has also collaborated with 100 partners, with over 1,000 stores for their Buy Now, Pay Later (BNPL) product. Some of Khazna's merchant partners include Raneen, 2B, Activ, and AMS.

Financials

Khazna has raised a total of USD 47 mn in funding to date. The initial pre-seed and seed rounds, amounting to USD 9 mn , were led by Algebra Ventures. In March 2022, Khazna announced their Series A round, raising USD 38 mn in equity and debt financing. The round was led by Quona Capital, with participation from Khwarizmi Ventures, Algebra Ventures, Accion Venture Lab, and others. The debt financing component was backed by Lendable.

Khazna hasn’t publicly disclosed any financial data. However, we can make a very rough estimate based on assumptions more than data.

Transaction volume: With our estimated 550,000 active users and considering the average income in Egypt (USD 150-200 per month), we estimate Khazna's monthly transaction volume to be around USD 90 mn (EGP 2.75 bn). NowPay published figures aligns with our estimate.

Outstanding loan value: Assuming 25% of users utilize Khazna's credit, borrowing an average of 25% of their annual income over the year, we estimate the outstanding loan value at around EGP 172 mn.

Annual Revenue: Assuming an average interest rate of 28%, average loan payback period of 6 months, and our previous estimate of total loan value. Our rough estimate for Khazna's annual revenue would be EGP 24 mn. (other potential revenue streams were not factored)

Strategic Powers & Economic Moats

Economics 101 is that perfect competition will drive all profits in the market down to zero. Firms will use strategic powers & economic moats to stop or hinder competition and protect their profits.. Without economic moats companies may encounter major strategic risks like pricing wars, erosion of market share, or brand irrelevance.

Khazna has a set of strategic powers & economic moats which include the following:

Economies of Scale

Economies of scale is the most common economic moat for businesses. Most financial services and tech companies have economies of scale. In Egypt, Financial services represent 0.75% of Egypt’s labor force, but contributes to 3.6% of Egypt’s GDP.

There’re clear economies of scale for Khazna as it is for any fintech player. The company can double or quadruple its outstanding loan value and consequently revenues, with significantly less increase in costs.

Operational efficiency & Low-cost

Marketing spend: Khazna's effective B2B2C strategy is a key driver in acquiring users at a low cost (CAC). This is a vital advantage in the fintech industry as many startups struggle with high CACs & are giving away their cash to Facebook & Google

Logistics bottleneck: In compliance with regulatory requirements for in-person KYC, a potential logistical bottleneck for financial services, Khazna avoids this bottleneck by partnering with employers & integrating with their payroll systems, outsourcing the KYC process to employers and reducing friction in the user experience.

System Lock-in & switching costs

Khazna has a robust system lock-in that incentivizes users to single-homing. While users can easily switch to other alternative finance platforms like ValU for BNPL, or digital ROSCAs like Moneyfellows, Khazna users who receive their payroll through Khazna can’t switch to other solutions unless they change jobs.

Khazna’s ecosystem's appeal lies in its seamless fully integrated user-experience

Seamless Salary Access: Users effortlessly their salary or pension directly through the app.

Financial Ecosystem: users can pay utility bills and make in-store purchases directly through the app, with no need to charge a separate wallet as it is the case with other payment apps.

Automated Credit repayment: Users can utilize credit and pay their installments back automatically with no need to do anything.

Income withdrawal: Users can withdraw the rest of his income through Khazna’s prepaid card

Embedding

While employers can potentially cancel partnerships with Khazna, the increasing adoption of Khazna's various financial products by their employees makes cancellation or corporate churn more difficult over time.

Network effects

Network effect might be the most effective defensibility for tech companies. Khazna's current solutions lack real network effects, that is their user doesn’t gain any additional value when a new user joins the platform.

Apps like Moneyfellows, the leading ROSCAs app in Egypt, have benefited from clear network effects due to the social nature of their products.

However, Khazna has the opportunity to cultivate real network effects by introducing social & collaborative financial products such as ROSCAs, P2P lending, & group lending.

Key Opportunities

Khazna has a lot of potential opportunities due to the massive underserved market they are operating in. The company has substantial growth opportunities through both product expansion and market expansion.

Product Expansion

ROSCAs

ROSCAs, commonly known as Money Circles or Game'ya, hold immense popularity among Egyptians, serving as a primary saving and credit mechanism. Money circles apps have achieved significant success in Egypt.

Khazna has a substantial opportunity in this space as well. By leveraging its effective B2B2C strategy, Khazna can encourage & incentivize employees within the same company to form and participate in money circles.

Digital Saving

savings is as important as credit for financial inclusion. In fact, solely focusing on a loan book metric may risk overburdening low-income users with debt. Instead Khazna can enhance its product offering and introduce tailored savings products that better serve their customers & improve their financial well-being. These could include:

Money Market Funds: Similar to Menthum, managed by Azimut Egypt.

Gold Certificates/Funds: Such as Azimut Gold, also managed by Azimut Egypt.

Sukuk Certificates: Offered by Abu Dhabi Islamic Bank.

Group Lending

Group lending is a unique concept that hasn’t been popular in the fintech space. Instead of individuals getting loans, a small group shares a loan. Every member is committed to paying it back. This system relies on trust as a social collateral rather than physical or monetary collateral. It’s advantageous for both lenders and borrowers. Lenders can help a riskier segment at a lower probability of default due to the social constraints. Borrowers, in turn, can access loans they couldn't get before at more competitive rates.

The digitization of group lending in Egypt would be a bold venture for Khazna or any other provider as it hasn’t been an untapped area. However, it can provide substantial value to the underserved market, notably in rural areas.

Key Risks

We believe that the macroeconomic situation in Egypt might be the most critical risk factor for the company

Interest Rates:

Issue: Negative real interest rates in Egypt, stemming from higher inflation rates compared to official interest rates.

Impact: Real returns from loan interest may be considerably lower than nominal return, affecting Khazna’s credit business.

Currency Devaluation

Issue: Egypt has witnessed three currency devaluations in the past 20 months, resulting in a 50% depreciation of the Egyptian Pound (EGP).

Impact: The official exchange rate at EGP 30.90 contrasts the black market rate nearing EGP 50. This devaluation intensifies pressure on real interest rates, directly affecting Khazna's business.

Default and Overuse Risk

Issue: High inflation, driven by currency devaluation, places significant pressure on the low and middle-income segments in Egypt.

Impact: Increased likelihood of overuse of credit solutions and rising default rates, potentially leading to higher churn rates as economic pressures escalate among the target demographic.