Table of Content

Company Thesis

Founding Story

Management Team

Product Offering

Market Analysis

Egypt’s consumer (grocery) spending

Q-Commerce & online grocery

Business Model

Operating Model

Procurement & Production

Warehouse management

Order Fulfillment

Delivery

Competitive Landscape

Incumbents

Disruptors

Traction & Growth

Installs

Active users & Orders

Financials & Valuation

Revenue & Revenue Growth

Funding

Valuation

Strategic powers & Economic moats

Economies of Scale

Process Power

Brand Power

Key Opportunities

Key Risks & Challenges

Summary

#1 Company Thesis

When Breadfast launched in 2017, it was one of the first companies in the region and probably globally that adopted a fully native supply chain model. While the common practice was to opt for a light-asset marketplace model like Uber, Airbnb, Instacart, Talabat or elmenus. Breadfast decided to differentiate and own their whole supply chain operations.

The underlying thesis is that there’s no reliability in emerging markets and margins in the groceries category are very thin. The way to win is to run breadfast as an ecommerce company, rather than a marketplace (Uber for bakeries). By taking full control of the supply chain and heavily investing in product quality, operational excellence and brand development, Breadfast aimed to deliver exceptional customer experiences and cultivate long-term customer loyalty that leads to increased repeated purchases and extended customer retention.

We can conclude that these are the two core pillars of Breadfast success;

Excelling in logistics and supply chain to enhance customer satisfaction.

Cultivating a strong consumer brand, positioning Breadfast as the best app for household essentials.

#2 Founding Story

In 2016, Egypt underwent a currency devaluation, resulting in the EGP losing 60% of its value. This prompted a significant brain drain and lots of talented people left the country for better opportunities. Mostafa Amin, an entrepreneur who founded four companies, contemplated whether to relocate to the US for a fresh start or persevere in Egypt.

After reflection and a thorough analysis of his past ventures, Mostafa decided to stay in Egypt and launch his fifth company. He realized there’s untapped potential within emerging markets like Egypt and he has an opportunity for success if he manages to avoid his previous mistakes.

Mostafa called two of his friends, Muhammad Habib and Abdallah Nofal, to join him and they decided to start a company together.

Despite lacking a concrete business plan or clear business concept, the founders started exploring ideas within the realm of AI, VR, AR. They would test each idea with 100-150 potential users and seek feedback from their investor networks. Any idea that doesn’t get positive feedback or doesn’t meet their predefined criteria was disregarded.

One year later, Mostafa & Habib were having dinner together and the first thing that came on the table was a basket of fresh Bread. inspiration struck Mostafa and instantly emerged as a pitch line: “freshly baked bread delivered to your doorstep every morning using a mobile app”.

#3 Management Team

The three founders share a common thread - prior entrepreneurial experience. Mostafa Amin, has launched 4 companies. He founded Wassel, Crunchbase of the MENA region, as well as Egyptian Streets, a prominent English news website in Egypt. Mostafa also served as COO at Speakol, a leading Ad-tech company in the region.

Mohammed Habib co-founded Nafham, a prominent Egyptian Edtech with 6 million users and was acquired by Tyro. Abdallah Nofal, was also a part of Nafham, and established MarginUX, a product design consulting firm.

Breadfast's leadership team includes seasoned executives such as Ayman Kaheel, former CTO at Raisa Energy and a former director at Cruise, and CFO Eugone Lee, a former food-tech investor at Prosus Ventures. The senior and mid-level management had extensive experience from global consumer and tech giants like P&G, Henkel, Mars, Amazon, and Vodafone, as well as regional startups like Careem, SWVL, and Wuzzuf.

#4 Product Offering

Breadfast started with offering freshly baked bread through a mobile app. Users place their orders in the evening and get freshly-baked quality bakery items delivered to their doorstep at 5:00AM. The company later expanded its offerings to include dairy products & Milk then to canned food and groceries. Following this offerings expansion, Breadfast introduced #Breadfast_Now feature which delivers orders within 30-60 minutes instead of next morning.

Currently Breadfast has a portfolio of more than 5000 SKUs categorized into two main groups: private label & sourced products

Private Labels: Produced by breadfast in-house or co-branded products that are developed in partnership with other brands

Bakeries & Pastries; the competitive edge of breadfast over other online grocery marts.

Specialty coffee

Ready to eat meals

Snacks & Protein Bars

Food cupboard

Homecare

Sourced products: The second category encompasses typical groceries and consumer packaged goods found in supermarkets, including dairy, meat, poultry, fruits, vegetables, snacks, personal care products, OTC medicines, baby food, pet supplies, laundry detergents, and stationary items.

Breadfast Pay: Bill payments method for utilities like electricity, gas, and internet, phone credit recharges, and gaming subscriptions such as Xbox through its app

Coffee outlets: Breadfast operates a chain of 13 coffee outlets in Cairo in New Cairo, Nasr City & Sheikh Zayed.

#5 Market Analysis

#5.1 Egypt’s consumer spending

Egypt’s population is over 110 million. That’s a lot of food each year, but how much food do we eat? And how much of it breadfast can capture? Breadfast has potential to capture EGP 42 bn (close to USD 1bn) spent on food & groceries by the top 10% consumer segment in Urban area,

So let’s break it down and derive these numbers (Access my calculations sheet here)

#5.1.1 Egypt's Food & Grocery Spending

In 2019, Egypt’s spending on food & groceries was around EGP 706bn equivalent to USD 42bn. (Fitch Solutions)

In 2020, the retail grocery market in Egypt was valued at USD 34bn. (FAS, US Department of agriculture)

In 2020, food & beverages accounted for 31% of total consumer spending, approximately EGP 506bn equivalent to USD 32bn. (CAPMAS, consumer spending report)

In 2022, Egypt’s spending on food & grocery was USD 63bn (EGP 1.2 tn) with 12.3% CAGR from 2017 to 2022 (Research & Markets)

#5.1.2 Household Spending Analysis

Egypt has around 25-26 million households.

In 2020, the average household spent EGP 62.6K per year, food spending making up 31.1% (EGP 19.1K per year).

The average household spending in urban cities is close to EGP 81.K, food spending accounts for 25.5% (EGP 20.5K)

The EGP has gone through 4 devaluations and food prices have increased by 140%. We can assume that average food spending has increased by 100%.

#5.1.3 Breadfast target market

Breadfast focuses on upper-class neighborhoods in Greater Cairo & Alexandria.

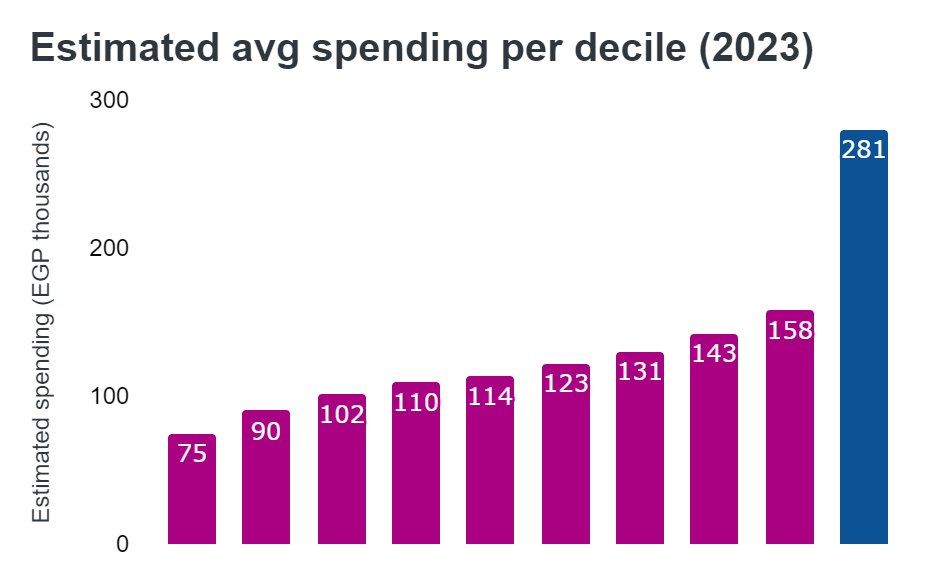

The top 10% of urban residents (700K household) spent around EGP 140K per household in 2020, and we estimate it rose to EGP 280K by 2023, food accounts for 21.1% (EGP 59K)

We can estimate breadfast addressable market to be EGP 41.5 bn, close to USD 1bn

Average consumer spending per bucket

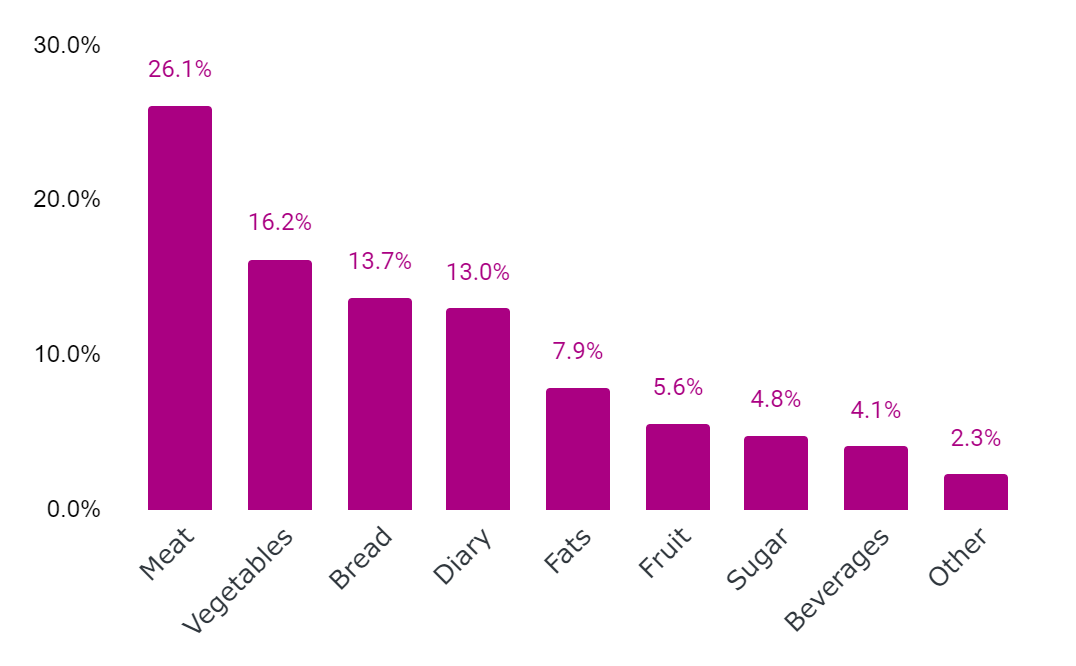

How do Egyptians allocate their grocery budget? Here’s a breakdown:

The average basket of a Breadfast user might be different than this initially as users will start using the platform with buying unique/cool products like pastries, oriental desserts or specialty coffee but as the platform grows and customers use it more frequently as an online supermarket it’ll gradually transition into the average distribution.

#5.2 Q-commerce & Online grocery

Quick commerce & online grocery delivery has seen significant growth post Covid-19 in both developed markets (Instacart, Gopuff, Gorillas, etc.) and emerging markets (Getir, Zepto, etc).

Global online grocery market is valued around USD 50.28bn and estimated to grow at a CAGR of 26.8% till 2030. The share of online grocery & Q-commerce represents 5-12% of total grocery sales in developed markets like USA & Europe.

However, online grocery in Egypt is still at a nascent stage, representing a small fraction of the market. According to E-commerce database (ECDB), Grocery e-commerce is estimated to be around USD 162.5mn in 2024. Statista estimates it to be around USD 509 mn in 2023. Here’s a snapshot of Statista forecast (updated in November 203).

Depending on what exchange rate we’re using for forecast, we can size up the market between USD 200mn to USD 500mn. This makes the share of grocery e-commerce 0.5%-1% of the total grocery market.

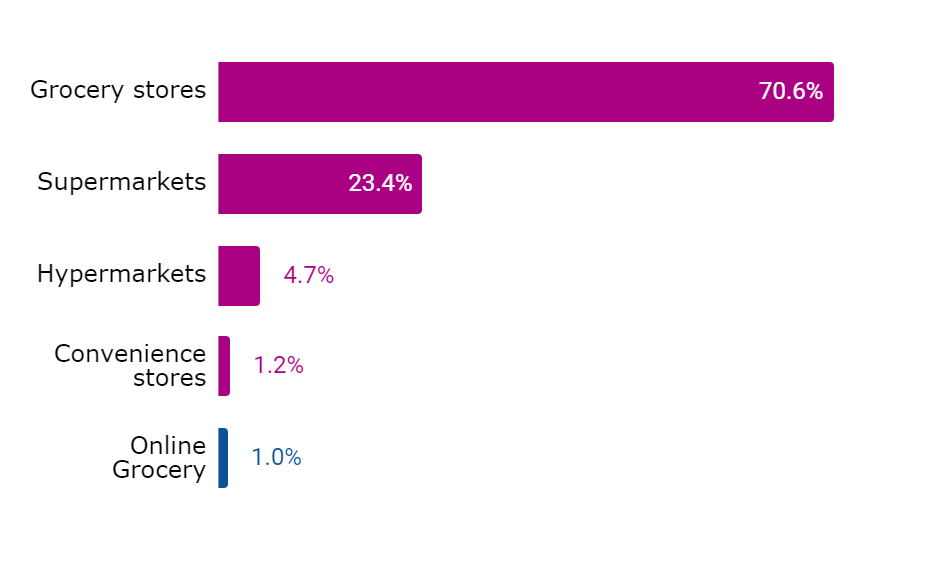

The reason grocery e-commerce represents a tiny fraction of total sales is due to the fragmentation of Egypt’s grocery market. As traditional grocery stores account for 70% of total grocery sales. (FAS, US Dept. of Agriculture)

#6 Business Model

Breadfast operates with a straightforward business model centered around selling a portfolio of products for profit, leveraging a mix of private label and sourced items.

Private label: Breadfast produces 40% of their SKUs in-house like bakeries & coffee as well as co-branded products like dairy and snacks. Fresh produce generally has better margins and private labels also improve margins as it reduces COGS. Additionally Breadfast positions their product as a premium offering, commanding higher prices. This gives Breadfast a great edge in achieving higher profitability levels.

Sourced products: The remaining 60% of SKUs are sourced directly from farms or renowned consumer brands like Juhayna, Nestle, Unilever, etc. Breadfast leverages its sales volume to negotiate discounted prices, which are then sold with a markup. Profit margins on Consumer Packaged Goods (CPGs) are slim, making private labels even more appealing.

Delivery Fees: Breadfast applies EGP 15-20 in delivery fees per order. These fees are primarily intended to cover packing and delivery expenses rather than generate profits.

Offline sales: In addition to online operations, Breadfast extends its reach through 13 coffee outlets located in New Cairo, Nasr City, and Sheikh Zayed.

#7 Operating Model

Despite the team’s tech background and being backed by global tech investors, Breadfast can’t be classified as a technology company. It is partially a tech company but also a food & beverage company, a logistics company and a last-mile delivery company. There are few companies who excel at both producing bread & coffee and developing scalable software systems. We can say that Breadfast is a supply chain company leveraging technology extremely well.

Breadfast owns around 28 dark stores where they store all of their inventory in a very efficient manner to help workers track, select, package and deliver as fast as possible.

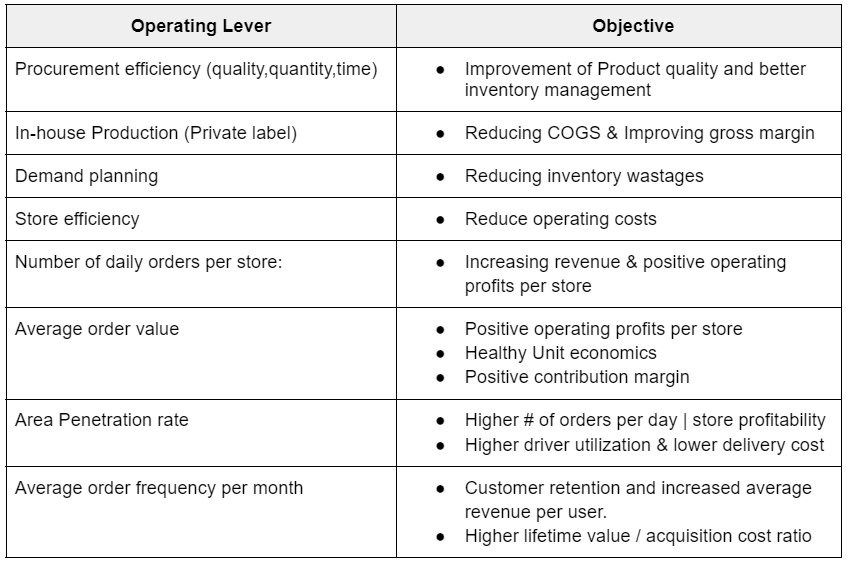

The company implements real-time stock tracking to ensure the app reflects current product availability. When a user places an order, the dark store staff get notified and start picking and packaging. A Delivery associate takes the order and the user’s data and delivers his order. For this process to be seamless for the user and profitable for the company at scale, Breadfast has to optimize several operating levers which is what makes it notoriously difficult to execute.

#7.1 Procurement & Production

Procurement efficiency in quality, quantity and time & demand planning to reduce wastage

Fresh produce is a highly demanded category in Q-commerce & the main driver of customer retention and also offers substantial margins. However it’s one of the most challenging categories. Breadfast must ensure perfect demand planning in order to produce enough products for daily demand but not more so it doesn’t have high wastages as these products shelf-lives are measured in hours.

Breadfast also must ensure a recurring efficiency of procurement. Raw materials & sourced products should be delivered with consistent quantity & quality on time.

#7.2 Warehouse management

Dark store layout & order handling and achieving certain order volume to be store-profitable

Dark stores must be organized & efficient so that workers can pick and package the order in 1-2 minutes. The company also must have great demand planning over the upcoming weeks to not overwhelm their stores with large inventory, which leads to inefficiency & delay.

There’s a high cost of running a dark store, from rent to utilities and labor costs. Each dark store must reach a certain order volume per day at a certain average order value to reach profitability. On average, it takes 400-500 orders per day to be profitable. Breadfast average daily orders per store is 587.

#7.3 Fulfillment

Maintaining order accuracy through training, inventory management and monitoring.

With high order volume, a lot of mistakes can happen, especially with large orders as users might request totally different items in 1 order. Order fulfillment inaccuracy (not delivering the right item) might cause huge customer dissatisfaction. The company must continuously train their staff and implement solid inventory management & monitoring systems

#7.4 Delivery

Increasing AOV and Orders per shipment to reduce costs & route optimization to increase efficiency

In emerging markets like India, Pakistan, and Brazil, delivery costs can account for 8-12% of revenue. This cost is burdensome when delivering low-margin products such as groceries.

Increasing Average Order Value: Boosting the average order value helps enhance unit economics and achieve a positive contribution margin. This strategy involves driving down the cost of picking and delivery as a % of revenue by encouraging customers to place larger orders.

Scaling Up in target neighborhoods: Reaching more customers in target neighborhoods can improve driver utilization. Divers can deliver more orders per hour, reducing labor costs as a % of revenue. Additionally, stacking orders together allows drivers to efficiently handle multiple deliveries in one trip.

Route Optimization: Implementing route optimization software enables drivers to take the shortest and most cost-efficient routes for all stacked orders. This approach increases the number of orders delivered per hour and lower delivery costs as a % of revenue.

#8 Competitive Landscape

Breadfast competition can be divided into 4 main buckets; Hypermarkets & supermarkets chains, traditional grocery stores & independent convenience stores/supermarkets, online grocery marketplaces, and online grocery supermarkets.

Traditional grocery stores: Approximately 120K small grocery stores in Egypt and account for 70% of total grocery sales. They will not be greatly affected by disruptors like Breadfast or its direct competitors. The reason for that was explained extensively in our market analysis section.

Hypermarket & supermarket chains: Hypermarkets represent less than 5% of grocery sales and supermarkets represent around 25%. Most of the hypermarkets and large chain markets like Carrefour, Spinneys, Gourmet Egypt, Seoudi, etc. have mobile apps for home delivery. According to E-commerce Database, Carrefour Egypt made close to USD 67mn in online sales in 2023, making them the market leader in the online grocery market in Egypt.

Marketplaces: These players decided not to take the native supply chain path and operate as an aggregator or connector between supermarkets and customers.

Instashop: Instashop is a UAE company which was acquired by Delivery hero for USD 360mn! They’re one of the largest players in the region and have been growing quickly in Egypt.

Goodsmart: Founded in 2014, the company operates on a unique subscription model and offers next-day delivery for groceries. Despite being in the market for 10 years, their app has 100K installs on Android and their coverage is very limited compared to other players.

Q-commerce:

Rabbit: A direct competitor for Breadfast, operating on a similar model to Breadfast as it sources thousands of SKUs, stores them in dark stores and delivers in 10-20 minutes. Rabbit doesn't produce bakeries and doesn't have private labels (for now) and has smaller reach than Breadfast.

Talabat Mart: The famous Talabat launched their online mart in 2020. Despite being an aggregator for more than 20 years, Talabat mart operates as a Q-commerce model and not a marketplace, the company operates dark stores across Cairo and promises to deliver your groceries within 30 minutes.

#9 Traction & Growth

#9.1 Installs

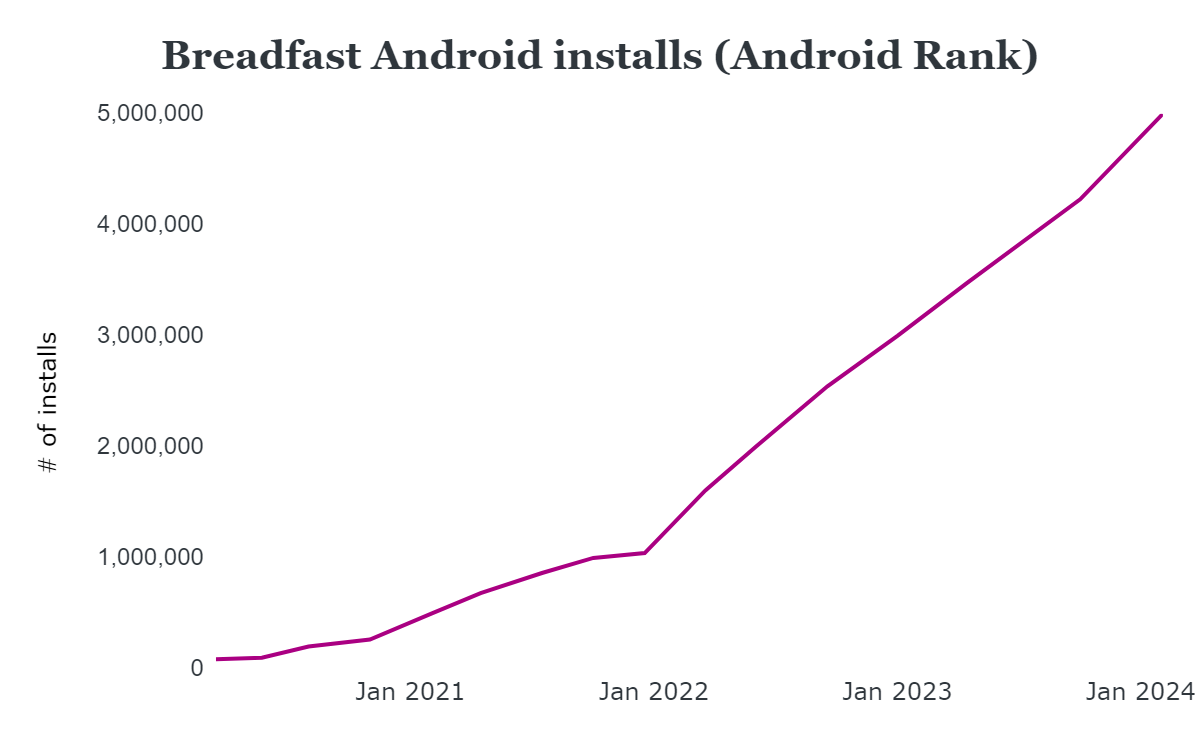

Breadfast has around 5 million installs(Android rank) and close to 1 million iOS installs(rough estimate). With an average Month-over-Month growth rate of 10.25%!

#9.2 Active Users & orders volume

Users: In 2021, Breadfast announced they served 170,000 households in Egypt with an impressive 25% monthly growth rate and 65% net monthly retention rate. However 25% MoM growth is not sustainable over the long or medium-term. At our estimated 10.25% average growth rate and 65% net retention, we can estimate that breadfast has exceeded 1 million active users by the end of 2023!

Orders: Breadfast has managed to deliver approximately 0.5 million orders per month in 2023 to 150,000 customers.(Vostok)

Despite their impressive achievements, Breadfast has under-delivered(pun intended). The company missed their 2022 target of 6mn deliveries and was able to achieve a year later. They also reduced their dark stores from 30 to 28 (despite targeting expanding to 40-50 stores). In addition they shut-down operations in cities like Mansoura & Tanta.

We think that this was due to various factors like global economic pressure, VC money tightening and national economic issues like currency devaluation & 140% food inflation.

#10 Financials

#10.1 Revenue

* You can access my calculations sheet here and manipulate the assumption inputs as you like if you have better insights.

Breadfast achieved 500,000 monthly deliveries in 2023, totaling approximately 6 million deliveries according to Vostok. Assuming an average order value ranging from EGP 100 to EGP 400, with an estimated average of EGP 250, plus EGP 18 delivery fees, estimated revenue stands at around EGP 1.6 billion or USD 34.5 million (USD/EGP = 47).

Breadfast has catered to 150,000 loyal customers as per Vostok data. Considering our market analysis indicating that the top 10% of Cairo's households spend EGP 59.3K on food & groceries, with an assumption that these customers utilize Breadfast for 15% of their consumption, the estimated revenue amounts to EGP 1.3 billion or USD 28.6 million (USD/EGP = 47).

With an estimated 1 million active users (have placed at least one order), and Statista's average revenue per user in online grocery at USD 27.3, the projected revenue for Breadfast is approximately USD 28.2mn.

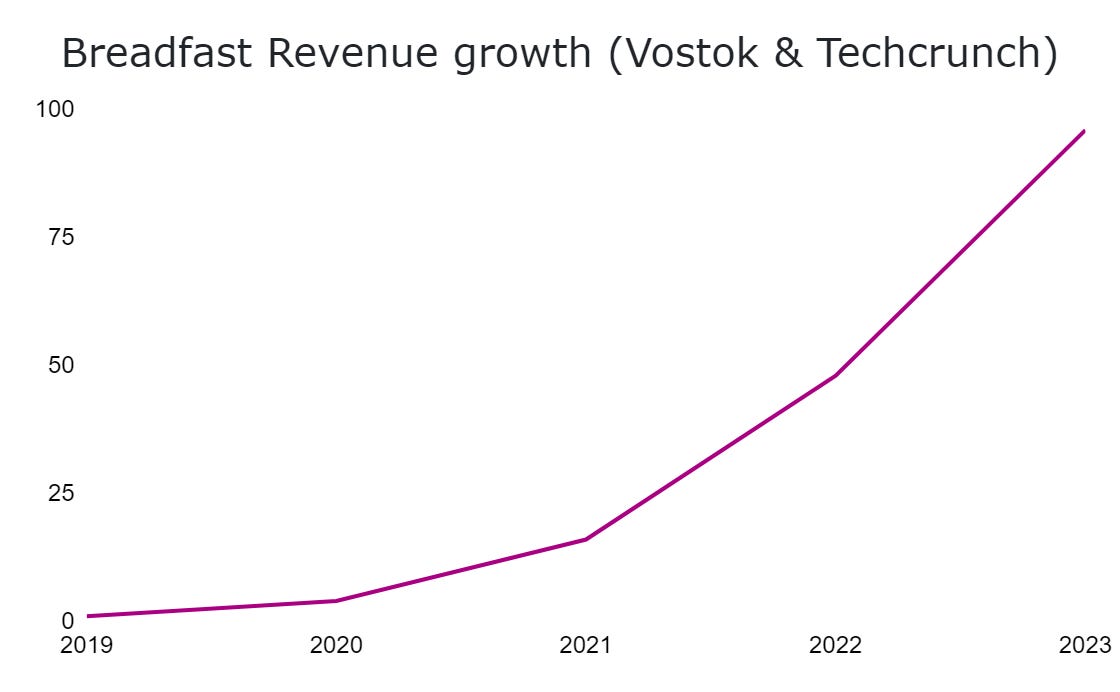

#10.2 Revenue Growth

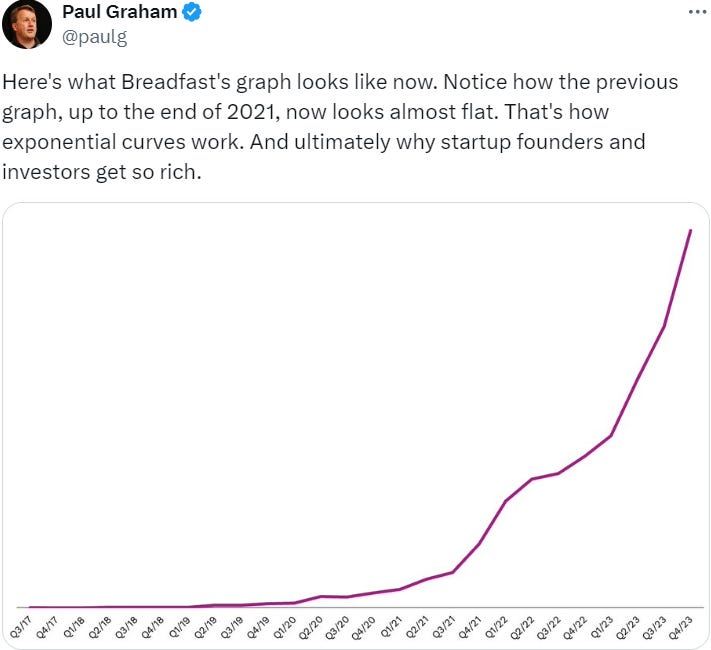

Breadfast's revenue quadrupled in 2020, tripled in 2022, and doubled in USD value in 2023. The revenue growth is illustrated in two charts, one by Paul Graham and the other by my analysis.

#10.3 Funding & Valuation

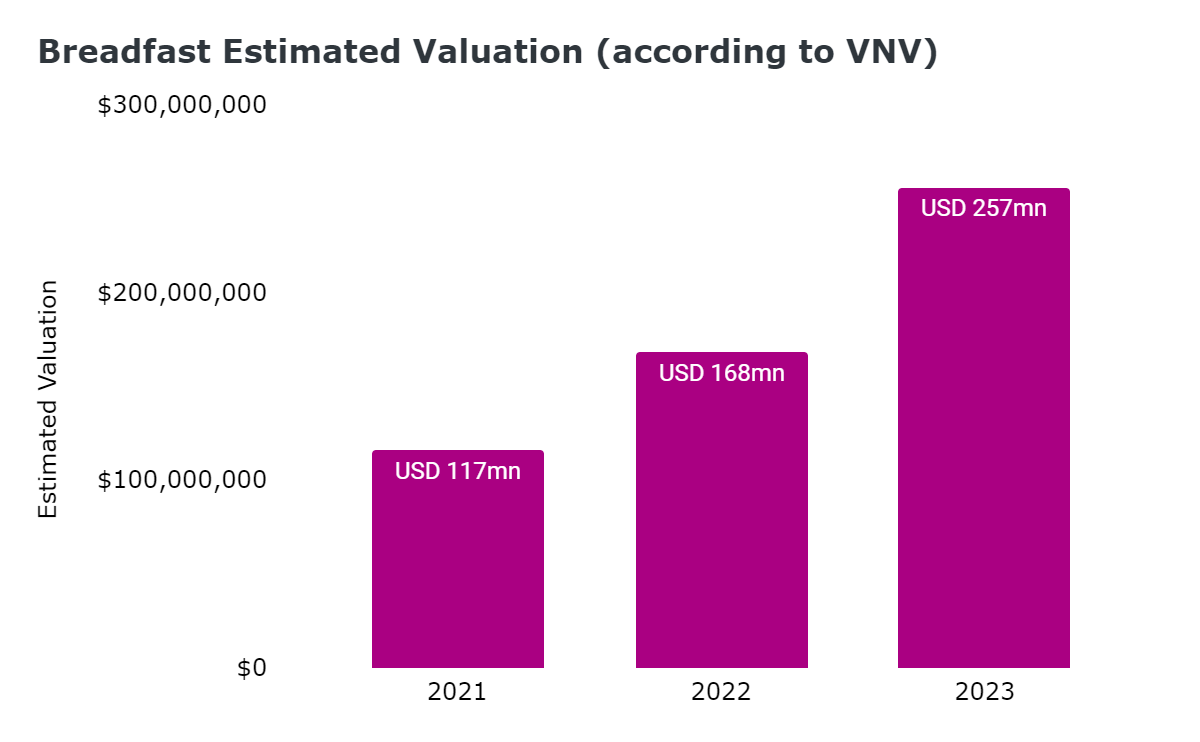

Since its establishment in 2017, Breadfast has successfully secured over USD 30 million in capital from various regional and global VCs, along with notable angel investors like Paul Graham. The company received pre-seed funding in 2017 from 500 Global, Averroes Ventures, and angel investors, followed by subsequent seed funding rounds including participation from Y Combinator (YC) in 2019 and a Series A round of USD 26 million in 2021 led by Endure Capital and Vostok New Ventures.

In 2023, Breadfast completed an unannounced undisclosed Series B round, contributing to its valuation of USD 257 million! showcasing consistent appreciation in value annually, unlike some global counterparts facing significant valuation cuts due to unfavorable unit economics and high burn rates (Getir).

#11 Strategic Powers & Economic Moats

Competing in a commoditized industry like grocery isn’t easy. Faced by competition from 100 thousand 1 person stores to mega corporations and many food-tech disruptors. Breadfast has several competitive edges and strategic powers that position it favorably in the highly competitive market of online grocery delivery

Economies of Scale: Due to the high costs of operating dark stores(rent, utilities, labor), reaching enough scale & penetration in each area is vital to achieve operating profitability on the store level and on the order delivery level.

Process Power:

Leveraging technology effectively, Breadfast excels in operational excellence and customer experience. The company's meticulous approach to mastering operations before expansion has built trust with customers and enabled their expansion from offering fresh bread next-morning to over 5000 SKUs and expanding across all the major neighborhoods in Cairo.

Breadfast has 28 dark stores, 27 of them are profitable. Most global peers are still burning cash with negative contribution margins. Getir was burning USD 100mn in cash every month and their valuation dropped by 75% in 2023. Gorillas were burning 1.50 dollars for every dollar they made.

Brand Power: The reason you order coffee and croissants from breadfast is not just because they just deliver them fast, but also because they make really great coffee and croissants. Breadfast has invested in building their brand since day 0. They were dedicated to making high-quality products and delivering great customer experiences. By hiring the best chefs & baristas, sourcing high-quality materials, maintaining operational excellence, the company has built a growing loyal customer base and strong brand name in a very short time.

What Breadfast lacks

Limited Scale Economics: The economies of scale for Breadfast are constrained to the neighborhood level, requiring substantial investments when expanding to new areas like dark store leasing, building production facility, & labor costs

Low Switching cost: Customers can easily switch to competitors, making maintaining customer retention and loyalty an ongoing goal.

No Network effects: Unlike marketplaces, Breadfast doesn’t benefit from any network effect that can drive exponential growth & strong user engagement.

No cornered resources: Breadfast's products, while of high quality, are not exclusive, limiting its ability to control unique resources in the mark

#12 Key Opportunities & Growth Potential

Breadfast got significant potential and growth opportunities just contingent on their execution ability to achieve optimal efficiency, and financial capacity to expand into new cities.

City Expansion: Breadfast has been expanding into new cities like Mansoura and Tanta (shut-down), and has potential to extend offerings to areas like El-Gouna or North Coast.

Country Expansion: Recently, Breadfast expanded into Riyadh and is likely to expand further into Gulf cities before targeting North African cities.

B2B Grocery: With expertise in the grocery supply chain, Breadfast can tap into the B2B segment by serving hotels, restaurants, and coffee shops.

Breadfast Kitchen: Leveraging their baking and brewing capabilities, Breadfast could venture into cloud kitchens to serve restaurants and cafes.

Advertising: Over the long-term, every platform is an advertising platform. Global online grocery players have benefitted from online ads due its low cost structure. However it might not be feasible for breadfast in many cases due to their expanding private-label offering.

#13 Key Risks

Macroeconomic Instability: Egypt's economic fluctuations, including currency devaluations and import restrictions, pose risks to Breadfast's operations and customer purchasing power. The company can de-risk this by expanding into more stable markets like the Gulf.

Operational Complexity: To run a company like Breadfast, You have to: source high quality products such as fresh vegetables, poultry, dairy, etc. & raw materials on time from various vendors. Produce consistent fresh food quality (bakeries & pastries). Perfect demand planning to ensure low inventory wastage. Maintaining high order volume at each dark store to ensure operating profitability. Continuous stock tracking for your inventory to not cause customer dissatisfaction. Deliver these orders on time, while maintaining 100% order fulfillment accuracy. Train your delivery associates to be brand ambassadors. Ensure safety delivery associates & store workers. Not an easy business to run, not easy to scale.

#14 Summary

Breadfast is an amazing supply chain company that leverages technology extremely well. The company’s business is an operational nightmare that’s very difficult to run at scale.

However, By being customer obsessed, investing in product and brand, leveraging technology and mastering all the operational key touchpoints, Breadfast managed to consistently deliver excellent customer experiences and build a large and growing loyal customer base. They managed to execute the Brian Chesky mantra of “Having 1000 customers that love you is better than a million customers kind of like you''

It takes a very special team to run that at scale!

Thank you for reading!

Great analysis and very insightful keep posting!

Amazing, keep going

thanks for this great analysis